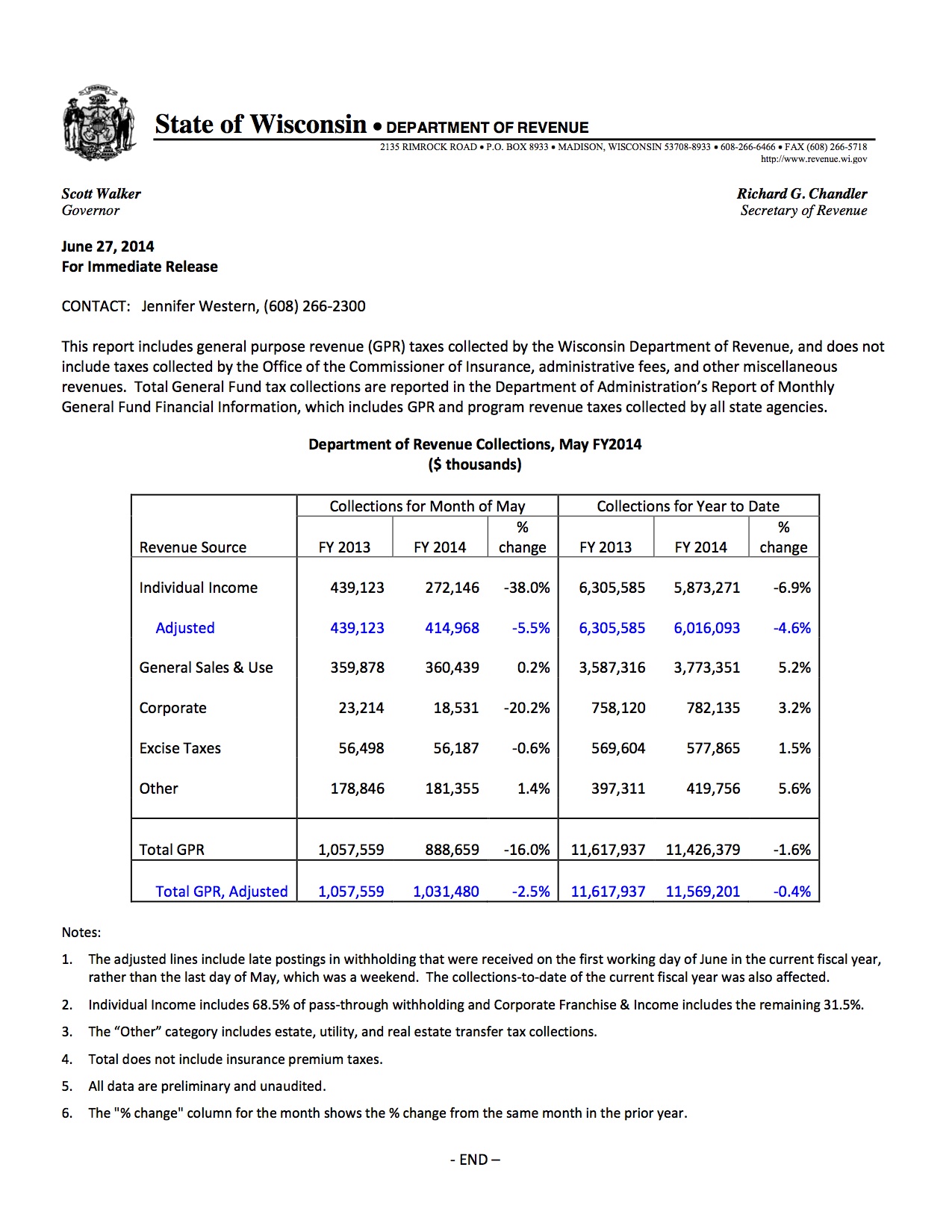

The Wisconsin Department of Revenue announced last week that nearly all state tax collections were down for the month compared to May 2013 (see chart below).

Corporate tax collections fell the most (20.2 percent), while income tax collections fell by 5.5 percent. State sales tax collections were up just .2 percent. Overall tax collections were down 2.5 percent for May and .4 percent year-to-date.

According to Wisconsin Public Radio, the Legislative Fiscal Bureau predicted earlier this year tax collections would increase by about 1 percent. As a result of those projections, Governor Scott Walker announced he would implement income and property tax cuts, citing a surplus of more than $900 million. Now, the state could end the year with $200 million less than predicted if collections continue to fall below projections.